Profile management: What it is and how to take action Cutting edge

Let’s look at a few money collection examples to learn the concept best. Diversity does not be sure a profit otherwise prevent loss in decreasing segments. To help you get already been, you could review preferred investment allocation habits to assist identify their better profile. “As opposed to an end purpose, the reasons why you want to purchase doesn’t matter,” claims Brian Robinson, a certified financial planner (CFP) during the Sharpepoint. Rebalancing (in addition to possibly titled readjusting) a collection consists of from time to time realigning the fresh percentage weightings of each and every private asset. It’s completely normal (and you can encouraged) to return on them one or more times per year to ensure your collection remains aimed with your requires and you can standard.

After you’re creating a collection out of scrape, it could be beneficial to consider design profiles giving you a structure based on how you may want to allocate your very own assets. Investigate advice lower than discover an atmosphere away from exactly how competitive, average and old-fashioned profiles will likely be created. This lady has safeguarded personal finance and using for over 15 years, and you may try a senior creator and you will spokesperson during the NerdWallet before getting an enthusiastic delegating publisher. Arielle has looked to your “Today” let you know, NBC News and you may ABC’s “World Reports This evening,” and it has been quoted within the national books like the New york Times, MarketWatch and you can Bloomberg Information. While you are all publicly traded enterprises blog post its economic overall performance results online, what is published by the businesses could be complicated for many people. Nevertheless don’t need to become a monetary elite group to read as a result of a few every quarter and you may annual reports to find out whether or not a great organization is broadening their revenue, funds, and money move.

- When you’re a new comer to spending appreciate controlling the profile on line, it will be the proper selection for you.

- 70-90% inside the stocks, 10-30% inside the government bonds, 10% in the cash in order to make the most of any funding one pops up.

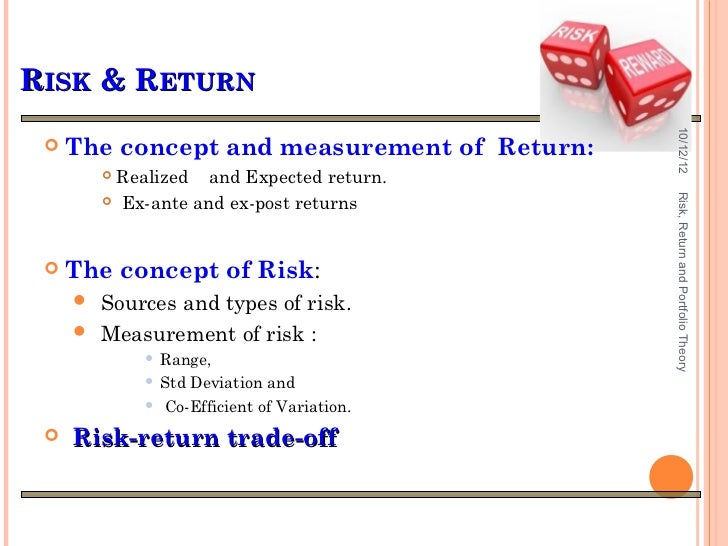

- Their risk threshold try tied up not just to how long you’ve got just before debt purpose for example later years, plus in order to the manner in which you psychologically deal with enjoying the market industry rise and you will slide.

- Going for assets to have retired people relates to balancing income means, exposure tolerance as well as the want to uphold funding.

Rebalancing | Quantum AI Elite

Once we mentioned, buyers can perform expert diversification that with shared financing and you may ETFs. These money car enable it to be individual investors that have relatively small amounts of money to shop for a collection of carries or other assets. If you’d like not to ever invest in common finance, ETFs will likely be a viable solution.

What’s a financial Portfolio?

Such as, should you have a good investment collection that have 60% holds and it risen up to 65%, you can also promote several of your own stocks otherwise purchase various other resource classes until your own stock allotment has returned from the 60%. This type of portfolio diversity is vital to managing the threats away from personal investment. Mutual finance and you can change-exchanged money ( Quantum AI Elite ETFs), which offer automated experience of many if not a large number of organizations, are great choices to assist any pupil buyer diversify the holdings. Rebalancing means promoting some holdings and buying more of anybody else very your portfolio’s investment allowance suits the means, chance threshold, and wanted quantity of output more often than not. The ceaseless-blend method retains repaired percentage allocations to different advantage categories.

- For example, should you have a financial investment collection that have sixty% holds plus it risen up to 65%, you could offer the your own carries or dedicate in other advantage categories up to the stock allowance has returned from the 60%.

- A financial investment collection is actually some financial assets for example holds, bonds, bucks, home, or other assets which can be owned by an individual otherwise treated by a monetary top-notch.

- Rebalancing (along with either titled readjusting) a profile contains occasionally realigning the new commission weightings of each individual asset.

- Anywhere between 2013 and you will 2023, merely 10% out of earnestly managed shared finance noticed more than half of the stock picks defeat the fresh market’s average, definition also elite money executives have trouble with stock picking.

Over the years, the worth of various other investment will change, resulting in the allotment in order to drift from its brand new address. Yourrisk endurance will get move through the years, which is Okay; just make sure you to alter the portfolio involved. Additionally you might need to to change the address portfolio mix while the your preferences and you can desires changes. An aggressive collection could possibly get work well while you are years of senior years. However, it collection will be too erratic in order to confidence whenever you are going to go wrong and require steady discounts to attract out of. Some buyers try comfortable with the opportunity of higher drops inside the the portfolio if they have time to recover and you will earn highest output through the years.

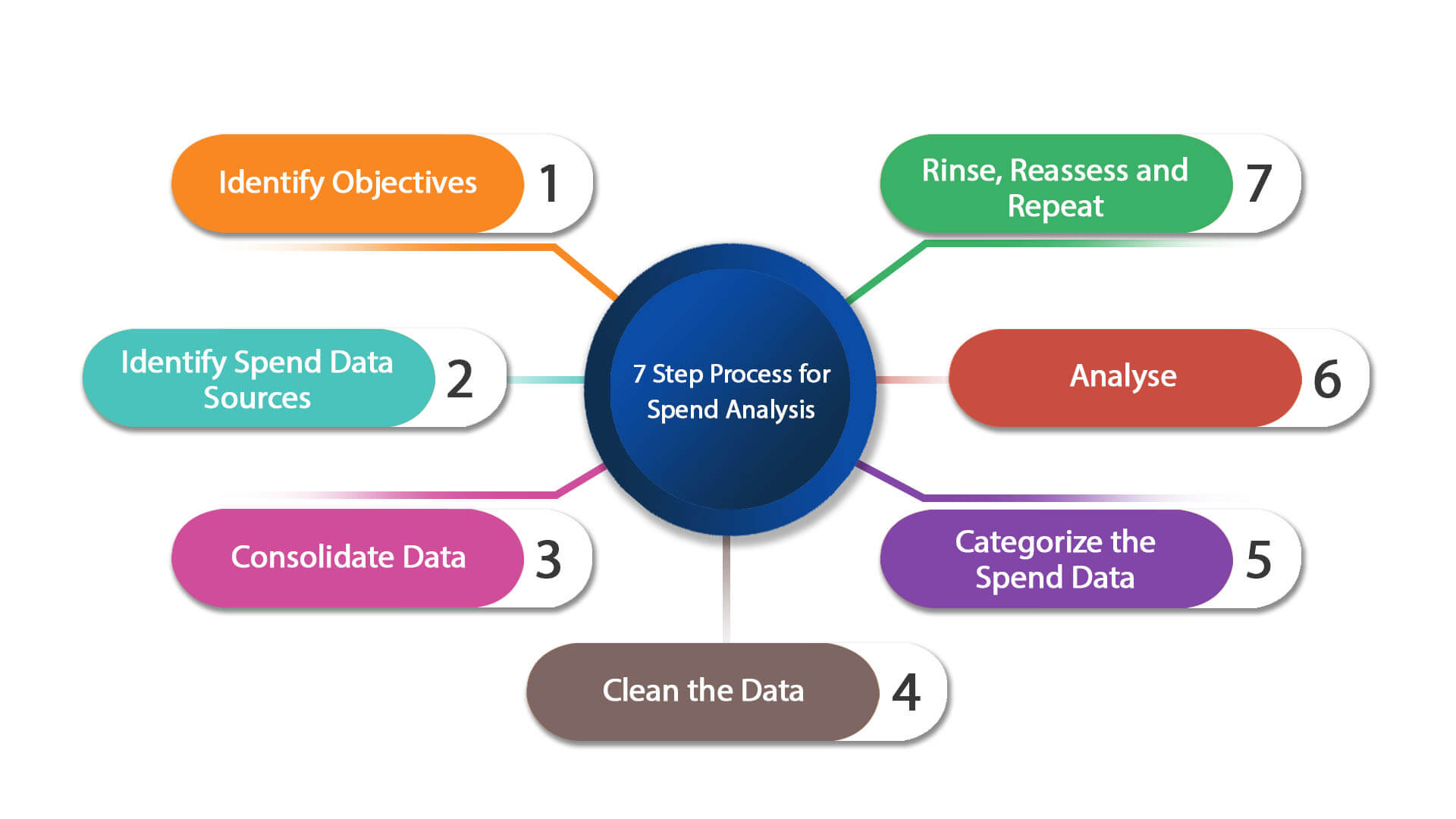

Carrying a broad set of opportunities helps to reduce the full exposure to own an investor. To create a good investment portfolio, a trader otherwise financial director would be to pay attention to the after the tips. Stocks contain money while the since the a family can make earnings, they shares area of the profits due to dividends to their stockholders. And, while the shares are bought, they are able to even be marketed at the a top speed, with regards to the efficiency of your company.

Time Panorama and you will Profile Allocation

Learning this type of account can provide you with each other a great qualitative and you can decimal feeling of how good a pals is performing. You should consider committing to businesses that subscribe to their lifestyle since the those is actually organizations you recognize anything regarding the. You can purchase more with full confidence within the familiar names compared to companies you’ve read about but never very learn. Committing to brief-cover and you can mid-cap companies that you might be used to, however, that aren’t the most famous try a method to enter to your higher businesses while they’re nonetheless growth holds. Profiles will be built to attain certain tips, away from directory duplication so you can money age bracket to help you money conservation. Diversity is seen as the best way to eliminate chance regardless of of one’s method without sacrificing the brand new profile’s requested come back.

Diversification

Centered within the 1993, The newest Motley Fool are a monetary characteristics organization serious about and then make the country smarter, happier, and you will richer. Recalibration is actually reassessing the new advantage loads and you may overall proper allowance based to your altering market criteria, private items, or the monetary mindset. “When costs are large, fewer shares are purchased, and in case prices are low, more shares is actually obtained,” the guy told you. “You may think counterintuitive, however you will get a lot more offers that are not as the effective in enough time away from get, and this over the years is always to help you earn more on your own opportunities.” You could make a well-varied portfolio on your own which have only several fund—or you can allow the advantages exercise with a goal-date finance. Financial advisers and you can robo-advisers may do portfolio variation to you personally, even though so it’ll been in the a slightly highest advanced than for many who did they oneself.

You can purchase otherwise promote possessions strictly centered on market activity, which can trigger underperformance over the long haul. If you can’t afford to purchase a single bond otherwise show from stock—or simply just have to dispersed their risk ranging from numerous stocks and bonds—you could potentially dedicate using change-exchanged financing (ETFs) and you can shared fund. To purchase a bond allows you to provide money in order to a friends, organization or town. Inturn, the connection issuer pays you attention on your own mortgage until they pay it off in full. Ties are generally less risky than simply stocks, however, there are even higher-chance ties including nonsense securities.

Internet Resource Worth (NAV) output are derived from the earlier-date closure NAV really worth during the cuatro p.meters. NAV efficiency imagine the newest reinvestment of all of the dividend and funding gain withdrawals from the NAV whenever paid. He extra one in identical year, the company’s funds jumped in order to EGP step three.cuatro billion, which is a critical increase because of the cash claimed inside the 2022 is EGP step 1.34 billion.

Ascertaining your own personal finances and you will needs is the basic task inside the developing a profile. Crucial what to believe is decades and how much time you have to construct your opportunities, and the amount of money to pay and you may coming earnings demands. Such advantage allocations are apt to have 40% to sixty% committed to holds. It have likely a higher go back and you can fluctuate over traditional allocations but not around aggressive allocations. The brand new vintage retiree collection are sixty% brings and you may 40% ties and cash.